Environmental, Social and Governance (ESG) schemes encourage investors to consider wider contextual factors when making asset allocation decisions and conducting risk assessment. Traditionally applied to corporations managing their operations or investors considering their investment targets, ESG considerations are also attracting the attention of sovereign entities who are keen to ensure that they can demonstrate aspects such as the long-term sustainability, social justice and accountability of their decisions.

The European Space Agency (ESA) Global Development Assistance (GDA) programme recognises the value of Earth Observation (EO) data in these ESG schemes, and, as part of its M&E and Impact Assessment (GDA M&E) activity, has released a Topical Overview covering this area. The use of EO for ESG schemes is an integral use case scenario for the newly-launched GDA Analytics Processing Platform (APP) as the cross-cutting nature of ESG aligns with the cross-cutting user-oriented software tools that GDA APP provides to International Financial Institutions (IFIs).

The involvement of IFIs in ESG

International Financial Institutions (IFIs) predominantly work with national governments, offering financing to meet sustainable development objectives. The creditworthiness of these sovereign entities is assessed against ESG factors and may therefore be used to determine the terms of financing instruments. Sovereign ESG scores are often driven by ingrained income biases at the national level because higher-income countries tend to have better governance and institutions and lower income inequalities (see Gratcheva et al., 2020). This means that developed countries often receive more funds than low-income countries given their higher ESG scores. Additionally, there are different views of what constitutes a good ESG score. Another big challenge with sovereign ESG has been translating environmental materiality into economic materiality. For instance, forest loss does not directly translate into economic input, which can make it hard to understand the impact deforestation has on for example the sovereign bond market.

Ultimately, there are three main ways that IFIs engage with ESG:

- Data provision: they curate and maintain a database on ESG-related factors.

- Advisory services: they raise awareness, guide, and increase the capacity of ESG issues among companies, investors, and governments.

- Standard setting: they develop and standardise ESG principles.

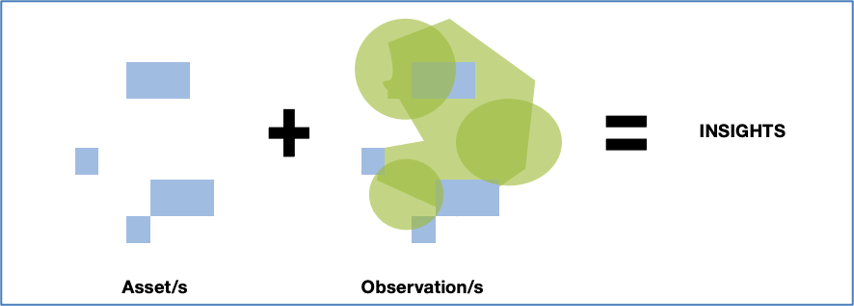

Geospatial ESG insights combine assets and observations from EO

To understand how EO brings value to ESG, it is important to understand how geospatial ESG works and how EO contributes to it. Geospatial ESG combines two forms of data:

- Asset data: datasets defining the location and property boundaries of commercial assets, their ownership, and key attributes of the asset class.

- Observational data: geospatially defined data that generates insights into an asset e.g., deforestation or methane emissions.

Geospatial ESG essentially starts with determining the accurate location and definition of ownership of a commercial asset. Satellite EO and Geographical Information Systems (GIS) can provide the observational data that is assessed against the asset.

EO data paves the way for better-informed ESG investing

Measuring environmental variables on the ground in-situ may be effective, but it is also expensive and difficult to scale. To provide up-to-date comparable insights, ESG analysts need results at both the company and country level that can be assessed at a high frequency and are consistent in their methodology. This has sparked the search for alternative solutions.

The report identifies a number of characteristics that make satellite-derived EO data advantageous, and why this matters for ESG. EO data can provide environmental insights at different scales that are independent, consistent, and repeatable at a high temporal frequency, making it particularly useful for the creation of consistent ESG insights at a global scale for millions of assets.

Enhancing ESG insights by leveraging EO in IFIs

Our report provides several examples of how IFIs have leveraged EO data to enhance their ESG activities.

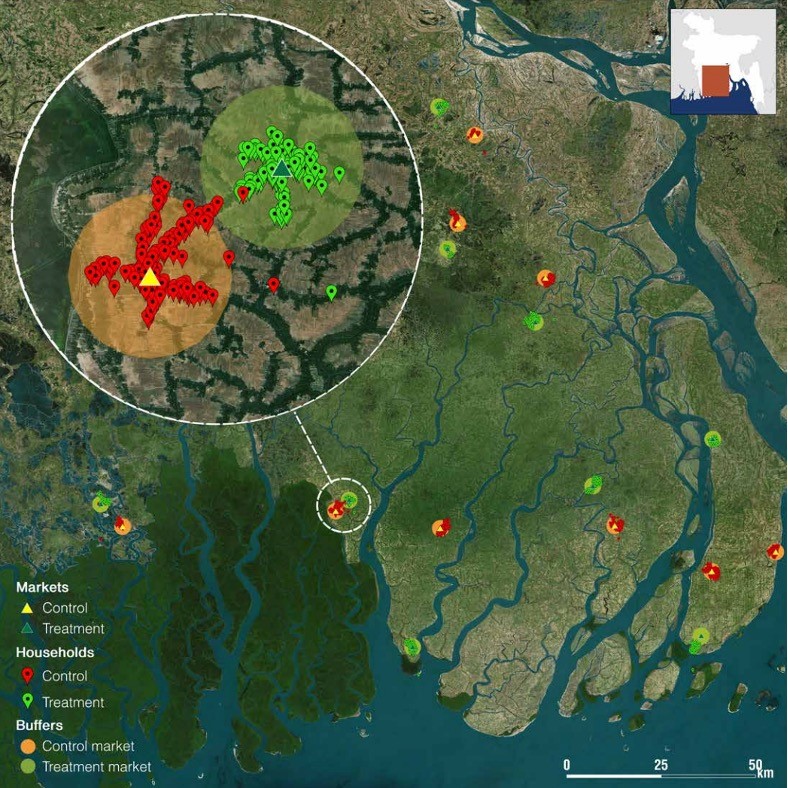

For example, to uncover the impact of rural investments on climate resilience, IFAD uses information gathered from household surveys as well as using GIS on climatic variables, to assess the impact IFAD’s investments have had on climate resilience.

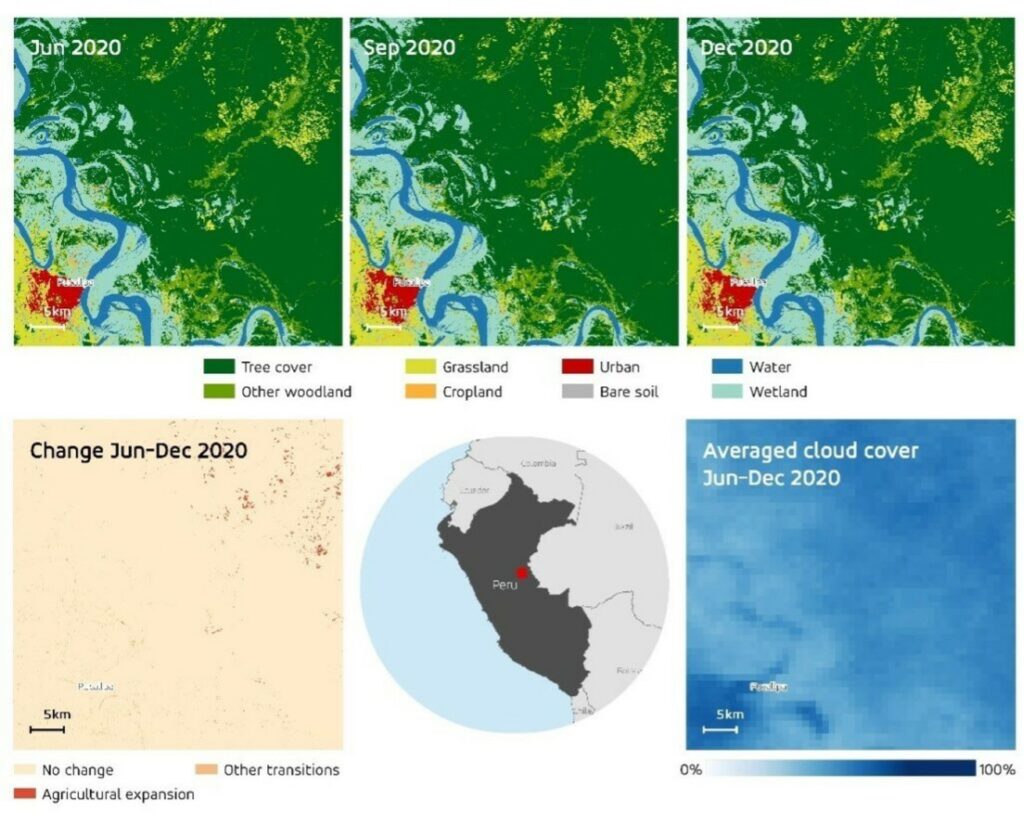

We also found various examples of how the World Bank (WB) is using EO/geospatial data for its ESG activities. For example, in collaboration with the WB, ESA’s GDA Agile EO Information Development (GDA AID) Climate Resilience Consortium, has conducted an in-depth study using optical and radar satellite data to generate insights into deforestation activities in the Peruvian Amazon rainforest. This can ultimately help guide further investments in Sustainably Linked Bonds (SLBs) and other financial tools that can encourage sustainable investment.

Unlocking the power of EO data for ESG in development operations

The nature of remote sensing means that it lends itself most to tracking observable changes in physical features such as forestry mapping or changes to urban infrastructure. EO alone is not enough to make complete ESG considerations – instead it has to be combined with other data sets such as national statistics on demographic changes.

There are other limitations and challenges to the use of EO data for ESG. For instance, it can be a challenge to establish a link between environmental and economic materiality. One way to address this challenge is exemplified by the WB-WWF project which estimated how strong the link between environmental and economic factors was by providing a geospatial view on droughts and employment in Brazil. By using a “flexible modelling approach” (see Patterson et al., 2022), which helps quantify meteorological events for economic decision-makers, the WB was able to conclude that shorter droughts had a more significant impact on subsequent employment during harvesting seasons compared to longer-term droughts where impact could be alleviated through adjustment efforts.

Next steps for EO-enabled ESG and ESA’s GDA programme

Use cases are essential to drive the use of EO data in ESG, and the ESA GDA has already led to case studies. Additionally, ESG will be a cardinal use case scenario of the GDA Analytics & Processing Platform (APP) activity, allowing users to explore the value of EO for ESG schemes, which will enable WB teams to develop products that support their ESG efforts. As the volume of case study examples increases, it will also be important for IFIs to share the value and learnings of using EO data for ESG with others to promote further mainstreaming.

The full topical report is available here. Please contact gda@esa.int with any questions.